Electric Vehicle (EV) penny stocks in India present an enticing opportunity for investors keen on the clean energy sector. These stocks belong to companies with valuations typically below INR 5 billion.

Electric Vehicle penny stocks have caught the eye of investors looking to capitalize on India’s push towards cleaner transportation. Eager market participants often consider these stocks as they could potentially offer significant returns due to the nascent EV industry’s rapid expansion.

As countries, including India, commit to reducing carbon emissions, the EV market is set to grow exponentially. Companies like HBL Power Systems and Reliance Power are among the few that have dipped into the sector, offering investors a chance at early entry into the electric revolution. These penny stocks come with higher risks, but for investors who perform diligent research and have a risk tolerance, they could be a gateway to lucrative rewards as India accelerates its shift to electric mobility.

Credit: www.analyticsinsight.net

The Rise Of Electric Vehicles In India

The buzz around electric vehicles (EVs) in India echoes the global shift towards sustainable transportation. With rising fuel prices and environmental concerns, the Indian market shows a soaring interest in EVs. This interest ripples through the investment world, where electric vehicle penny stocks become exciting prospects for those eager to tap into the burgeoning EV market.

Market Drivers And Growth Potential

- Skyrocketing fuel costs prompt consumers to seek alternatives.

- Environmental awareness shifts preferences towards cleaner vehicles.

- The technology advancements make EVs more attractive and feasible.

- Cost reductions in batteries encourage EV adoption.

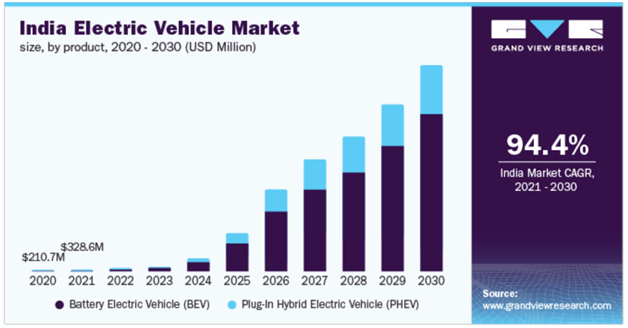

Analysts predict a steep growth curve for the Indian EV sector. The market size is expected to expand significantly. This growth provides an excellent opportunity for penny stock investors. These stocks often represent smaller or startup companies poised to grow alongside the industry.

Government Initiatives And Policies

The Indian government plays a crucial role in fostering the EV ecosystem. It introduces various support measures and incentives. Examples include tax rebates and subsidies for EV buyers.

| Policy | Impact |

|---|---|

| FAME-II | Encourages electric two-wheelers and buses adoption |

| PLI scheme | Incentivizes local manufacturing of EVs and components |

| GST cuts | Reduces the cost of EVs, making them more affordable |

Policies create a favorable investment climate for EV-related enterprises. They make electric vehicle penny stocks in India a potentially lucrative option. With such government backing, these companies could witness accelerated growth in the near future.

Credit: m.youtube.com

Penny Stocks: High Risk, High Reward

Exploring the world of Electric Vehicle Penny Stocks India is akin to sailing into the thrilling yet stormy seas of the stock market. Penny stocks represent both high risk and high reward, tempting the daring investor with the promise of potentially substantial gains. With India’s electric vehicle (EV) sector gearing up, these stocks are becoming a hotbed for speculative investment.

Characteristics Of Penny Stocks

Penny stocks share unique features that set them apart. Here’s what you should know:

- Low price per share: They trade at less than ₹50, making them easily accessible.

- High volatility: Prices swing widely, sometimes within a single trading day.

- Limited information available: Fewer data insights can make informed choices tougher.

- Illiquid nature: Not easy to buy or sell swiftly because of low trading volumes.

Why They Appeal To Investors

Despite the risks, investors are drawn to penny stocks for compelling reasons.

- High profit potential: Gains can sky-rocket from meager investments.

- Entry point for beginners: With low capital investment, new investors can jump in.

- Quick movements: Sudden price jumps can translate into rapid profits.

Identifying Smart Electric Vehicle Penny Stock Buys

Excitement is building for Electric Vehicle (EV) Penny Stocks in India, as investors search for the next big thing in the surging EV industry. These low-priced stocks could become game-changers for daring portfolios. But, spotting the right investments requires more than just luck. Let’s dive into the approach for identifying smart EV penny stock buys.

Research Methodologies

Effective research is the cornerstone of any successful investment. To uncover promising electric vehicle penny stocks, consider these pointers:

- Industry Trends: Look at the latest developments within the EV sector.

- Company Analysis: Assess the business model and growth potential of the company.

- Market Position: Evaluate where the company stands compared to competitors.

- News Coverage: Stay updated with press releases and media stories that may impact stock prices.

- Trading Volume: Monitor for consistent trading activity to ensure liquidity.

Financial Health Indicators

Using financial health indicators helps to determine whether a company is a worthy investment. Here are several key metrics to analyze:

| Indicator | Description |

|---|---|

| Earnings Per Share (EPS) | Indicates the company’s profitability. |

| Debt-to-Equity Ratio | Measures financial leverage and stability. |

| Price-to-Earnings (P/E) Ratio | Compares current share price to per-share earnings. |

| Return on Equity (ROE) | Shows how effectively management uses investment funds. |

Look for EV penny stocks with healthy margins and low debt ratios. A good balance sheet and positive cash flow can be signs of a strong future contender in the EV market.

Top Electric Vehicle Penny Stocks For 2023

As the electric vehicle (EV) market charges ahead, investors are eyeing the potential windfalls from EV penny stocks. These stocks represent small companies with share prices typically under a dollar, offering access to the burgeoning EV sector without the hefty price tag of established players. With the Indian government’s strong push towards EV adoption, 2023 brings new prospects for early-stage investors in the EV domain. Let’s explore some of the top picks that could electrify your portfolio.

Promising Companies And Their Prospects

EV penny stocks in India offer unique growth opportunities. These companies, though small, are rapidly adapting to the EV wave. With innovative technologies and strategic partnerships, they are poised to capture a significant share of the market. Below are some potential frontrunners:

- Hightech Gears Limited: Gaining traction with their advancements in EV powertrain solutions.

- JBM Auto: Known for their electric buses, they are scaling up their EV components division.

- Minda Industries: Venturing into EV parts, this company is set to capitalize on the industry’s expansive growth.

These stocks are high-risk due to their price volatility but could yield substantial returns if the companies thrive.

Analyst Opinions And Market Sentiment

Market experts often have varied views on penny stocks. It’s crucial to gauge analyst opinions and overall market sentiment before investing. As of 2023, the sentiment around Indian EV penny stocks is generally positive, given the government incentives and a favorable market ecosystem for EVs. Let’s look at a summary of analyst insights:

| Company | Analyst Rating | Growth Potential |

|---|---|---|

| Hightech Gears Limited | Bullish | High |

| JBM Auto | Mixed | Moderate |

| Minda Industries | Bullish | High |

Analysts highlight that while the risk is present, the potential upsides are hard to ignore.

Investment Strategies For Electric Vehicle Penny Stocks

When eyeing the bustling sphere of Electric Vehicle Penny Stocks in India, smart investment strategies become crucial for navigating this emerging market. These tiny titans may pack a powerful punch in the green revolution, but they also carry unique risks and potential rewards. Understanding how to strategically invest can unlock value and mitigate risks in this dynamic sector.

Diversification And Portfolio Management

Diversification stands as a core pillar in minimizing risks. This approach involves spreading investments across different electric vehicle penny stocks. This reduces the impact of any single stock’s downturn. A well-diversified portfolio might include:

- Battery manufacturers

- Electric motor companies

- Charging infrastructure providers

To manage such a portfolio, investors need to:

- Track industry trends

- Review company financials

- Adjust holdings with market shifts

Staying updated on sector movements ensures a nimble and responsive investment strategy.

Long-term Vs Short-term Investment Approaches

When considering time horizons, investors need to choose between long-term and short-term strategies:

| Long-term | Short-term |

|---|---|

|

|

The long-term approach fosters patience and persistence, aiming for gradual wealth accumulation. The short-term approach, on the other hand, seeks to exploit rapid price changes for quick gains.

Ultimately, aligning investment choices with financial goals and risk appetite can guide whether to adopt a long-haul perspective or to play the swift moves of stock trading.

Risks And Potential Rewards

Exploring the electric vehicle (EV) penny stock market in India brings with it the thrill of potential rewards. Bold investors could seize opportunities as the EV market expands. Yet, risks loom large, with high volatility being a significant challenge. Understanding both sides of the investment coin is crucial for any investor diving into this dynamic field.

Volatility And Market Unpredictability

Volatile markets can turn fortunes overnight, especially when it comes to penny stocks in the burgeoning EV sector. These stocks are susceptible to swift changes due to news, regulations, and investor sentiment. Here’s what makes them a double-edged sword:

- Low liquidity can lead to sudden price swings.

- Less coverage by analysts might mean less available information.

- Market speculation often drives prices more than fundamentals.

Investors must brace for this unpredictability. Keeping a close eye on industry trends and doing thorough research remains vital.

Case Studies Of Past Successes And Failures

History teaches us important lessons. It’s enlightening to examine case studies of previous EV penny stock performances. Success stories can inspire, while failed ventures serve as cautionary tales.

| Company Name | Outcome | Key Factor |

|---|---|---|

| EV Tech Ltd. | Success | Innovation in battery technology |

| Green Motors Corp. | Failure | Poor scalability |

Dig into the past to understand stock trajectories. Emerging patterns give clues to what may lie ahead. Staying informed is your shield in the EV penny stock arena.

Credit: www.5paisa.com

Frequently Asked Questions Of Electric Vehicle Penny Stocks India

What Are Electric Vehicle Penny Stocks?

Electric vehicle penny stocks refer to shares of small-cap EV companies trading at low prices, often below $5. Investors consider them high-risk, high-reward investments due to market volatility and growth potential in the EV sector.

How To Invest In India’s Ev Penny Stocks?

To invest in India’s EV penny stocks, you can open a brokerage account with platforms offering access to Indian stock markets. Research and choose stocks carefully, given their speculative nature, and monitor the EV market for trends and developments.

What Risks Come With Ev Penny Stocks?

EV penny stocks carry risks like limited financial history, low liquidity, market volatility, and regulatory challenges. Due to their speculative nature, they’re riskier than established stocks, making due diligence prior to investing essential.

Are Penny Stocks Good For Beginners?

Penny stocks are generally not recommended for beginners due to their high volatility and lack of reliable information. It’s crucial for investors to understand the risks and possess the ability to manage potential losses.

Conclusion

Diving into the realm of electric vehicle penny stocks in India offers promising opportunities for investors ready to navigate a dynamic market. As the nation accelerates towards green transportation, these stocks present potential for growth. Remember, thorough research and risk awareness remain vital before investment.

With the right strategy, your portfolio could harness the power of India’s EV revolution.